Turbo Takeaways

- Consumer credit scores impact a range of financial decisions and opportunities.

- While it’s possible to function with low credit scores, higher values often lead to better outcomes for consumers.

- Many consumers already carry credit scores that are considered “Good” to “Excellent.”

What Are Credit Scores?

Credit scores are triple-digit numbers representing a consumer’s financial health and potential risk to lenders. Lower credit scores show lenders that borrowers might miss or fall behind on payments within 90 days. Conversely, a higher credit score indicates less risk for delinquency and more security that creditors will receive payments.

Credit reporting agencies build scores based on how consumers use credit and meet financial obligations. These organizations use scoring models to calculate a three-digit number indicating your risk. Scores are based on financial data that creditors and lenders provide to each credit reporting bureau.

Consistently paying bills and credit card balances raises your credit score and proves you can manage your finances in a way that poses less risk. Even if you’ve missed payments or carried a balance, your credit score can improve after paying off debts and continuing to make smart financial choices.

How Credit Scores Are Calculated

Your credit score is calculated using a scoring model based on input from the three major credit reporting agencies: Equifax, TransUnion, and Experian. Each organization accepts reports from creditors about consumer debts, building a profile of factors like payment history, credit utilization, and new credit. However, each of the three credit bureaus collects slightly different information, making scores vary slightly across each organization.

Credit reporting agencies use a mix of five factors to determine consumer credit scores. Each factor accounts for a different percentage of the overall calculation, with some weighted more heavily than others.

Payment History (35%)

Since this category weighs more than any other factor, consistently paying bills in full and on time is the most effective way to ensure a stronger credit score. Even one account paid late can negatively impact your credit.

Other issues, such as bankruptcy, foreclosure, or unpaid bills, can have lasting negative consequences that affect your payment history and lower your credit score. Conversely, consistently making payments on time proves your creditworthiness and improves your credit score.

Credit Utilization (30%)

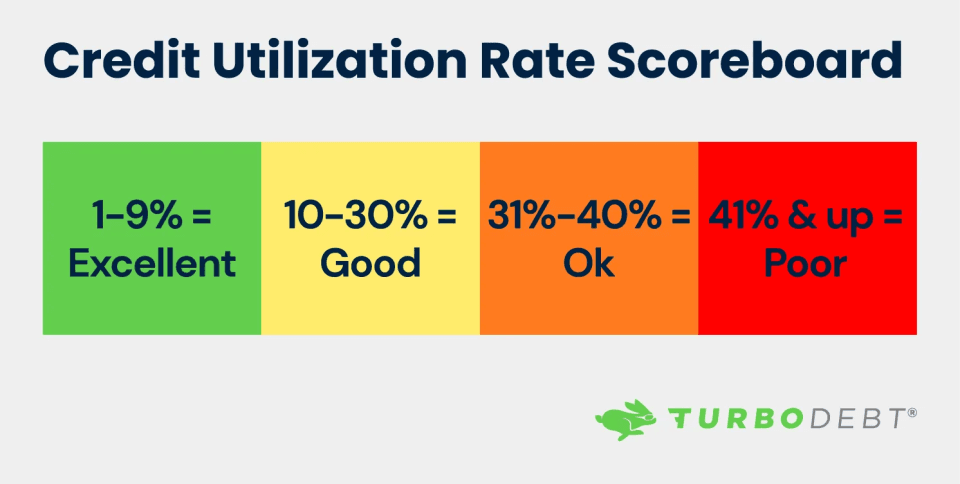

Every credit account has a limit that controls how much you can charge or borrow. Credit utilization refers to how much of their available credit a consumer uses. The higher your credit utilization ratio, the more lenders see you as a risk. Since this is also a weighty factor in calculating credit scores, it’s important to determine your ratio and work to keep it at 30% or less.

Start by calculating your total available credit across all accounts. Next, find the total balance on those accounts. Divide your outstanding debt (total balance owed) by your available credit and change the answer to a percent (multiply by 100) to determine your utilization ratio.

Age of Credit History (15%)

While everyone has to start somewhere, how long you’ve held credit accounts is a critical factor used to calculate consumer credit scores. Your credit history begins when you first start borrowing on credit, so opening that initial card and using it responsibly with the help of a parent or mentor may benefit young adults.

However, what really matters to lenders is simply that the longer your credit history, the more data you leave behind to prove how risky or safe you are as a borrower. Even after you close an account or pay off a loan in full, the length of time you held that account remains part of your history for up to 10 years.

Credit Mix (10%)

A credit mix indicates how consumers use credit and pay off debts across various types of accounts. Scoring models favor a mixture of both revolving and installment credit. Revolving accounts include credit cards and lines of credit, while installment accounts involve paying off a specific amount, such as mortgage debt or an auto loan.

New Credit (10%)

Your credit score is affected each time you apply for a new credit account, whether it’s considered revolving or installment. Applying for new lines of credit or even shopping for rates is considered a “hard inquiry” and may cause a dip in your credit score.

However, applying for a new credit card and checking rates on options like student loans are handled differently by credit-scoring models. While applying for a credit card usually dings your score each time, as long as you shop rates for loans within a two-week window, each inquiry is lumped together to count as one.

FICO vs. VantageScore

Consumer credit scores are calculated using two models. The most popular model uses data from the Fair Isaac Corporation (FICO). Some creditors and lenders also accept an alternate model called VantageScore.

Since FICO is more widely used, most statistics and calculations consider ratings based on this model. Although similar, Vantage scores tend to be more generous in granting excellent credit while also putting higher scores than FICO into the “Poor” category. This key difference could affect some consumers with lower scores when lenders use this model. However, both Vantage and FICO scores use the same range (300-850) to determine credit ratings.

Key Differences Between FICO and VantageScore

FICO and VantageScore are the two most common credit-scoring models, but they have several important differences. Here's a side-by-side comparison:

| Feature | FICO | VantageScore |

|---|---|---|

| Usage | Used by 90% of lenders | Used by some lenders and credit monitoring apps |

| Scores | Include a separate score for each agency, creating a three-score report | Uses a single score that combines info from all three agencies into one |

| Scoring Range | 300–850 | 300–850 (but ratings vary slightly, with a broader range for the highest and lowest scores) |

Buy Now Pay Later (BNPL)

It’s important to note that FICO recently announced plans to start including credit data from consumers who use Buy Now, Pay Later loans. Until recently, consumers could purchase small to moderately priced items with the option to set up installment payments at checkout without any of the data affecting credit reports.

While BNPL purchases have a long-standing role in America’s financial history, credit reporting agencies traditionally overlooked this type of loan when compiling data. However, FICO plans to roll out new scoring models to include BNPL choices in consumer credit scores starting as early as Fall 2025.

What Is Considered a Good Credit Score?

With credit scores ranging from 300 to 850, most consumers fall somewhere in the 600s or 700s. In fact, the average American credit score remained the same from 2023 to 2024, sitting at a strong 715.

Under the popular FICO rating system, scores 670 and up are considered good, with scores topping 740 rated “Very Good” or “Excellent.” However, once your credit falls below 670, you’re risking scores rated “Fair” and “Poor,” making it harder to secure loans or new lines of credit.

Credit Score Ratings by Model

| Rating | FICO Range | VantageScore Range |

|---|---|---|

| Excellent | 800-850 | 748-850 |

| Very Good | 740-799 | 716-747 |

| Good | 670-739 | 661-715 |

| Fair | 580-669 | 600-660 |

| Poor | 300-579 | 300-599 |

Why Does a Good Credit Score Matter?

You may wonder why maintaining a decent credit score matters so much. Since lenders value credit scores as a reliable measure of risk, keeping your credit score in the “Good” range makes transactions easier for you, the consumer.

Here's what good credit can do:

- Secure loans for higher amounts

- Make it easier to apply for new lines of credit

- Provide lower interest rates on car loans and mortgages

- Ensure lenders are more likely to consider and accept loan applications

Many consumers already fall into the range of “Good” or higher credit scores. But for those who don’t, taking a few practical steps to improve credit isn’t a difficult process. Educating yourself about credit scores is a great way to start.

How To Build Credit and Repair Credit Scores

Because credit scores weigh heavily on big purchases and necessary lines of credit, it’s easy to feel trapped when you have a lower number. Thankfully, if your scores take a dip, you can fix your credit by taking steps to rebuild your finances.

- Pay Off Debt

Clearing debt is an effective way to raise your credit score and restore your finances. Consider using professional debt relief to reduce what you owe and pay off debts faster with expert guidance. Although your credit may dip during the debt relief process, once you end your debts and start making full, on-time payments, your score can rapidly improve. - Make On-Time Payments

Since paying bills on time accounts for the biggest percentage of your credit score, making timely payments is the quickest way to elevate your numbers. Creating a budget can help you make smart financial choices and organize bill payments. Consider using a budgeting tool or app to help you track expenses and set reminders. - Avoid New Credit and Maintain What You Have

Closing out current credit accounts won’t help your score, but neither will opening something new. When you’re trying to repair and raise credit, the best thing you can do is pay off balances and sustain your active accounts. - Clear Up Disputes

It’s possible to find mistakes in your credit history. That’s why it’s important to regularly review your credit and dispute any incorrect data you find. If you notice an error, file a dispute online, by mail, or by phone through one or more of the three credit reporting agencies. It’s even possible to freeze credit scores if you suspect someone is trying to use your identity to open credit accounts.

Monitoring Your Credit

Maintaining a strong credit score is often easier if you monitor it from year to year. Consumers are entitled to one free annual credit report, but can choose to pay for more inquiries. Experts recommend checking your credit monthly, but at the very least once a year, to track changes.

Consider using a credit monitoring service that alerts you when your credit changes, either from official updates or fraud. These services typically cost money and may offer tiered service levels, including depth of data and frequency of alerts.

Manage Your Debt With TurboDebt®

Take the first step toward controlling your financial life with a trusted debt relief partner like TurboDebt®. We’ve helped thousands of consumers pay off debt faster for less than they originally owed.

With over 20,000 positive reviews on Trustpilot and Google, our clients prove that it’s possible to pay off debt and thrive with a little help from our team of experts.

It only takes a few minutes to find out if you qualify for our debt relief program. Regardless of your credit score, contact us today to start your free consultation.