TurboTakeaways

- TurboDebt® offers debt relief services that help consumers negotiate a reduced payoff amount with creditors.

- Debt relief options can impact your credit score, but the benefits often outweigh a temporary drop in scores.

- Credit scores reflect consumer financial habits and fluctuate based on data collected by the three major reporting bureaus.

How Debt Relief Programs Work

When you’re carrying thousands of dollars in unpaid balances from credit cards, medical bills, or personal loans, it can seem impossible to get out of debt. Even when you’re earning income, everyday living expenses and unexpected needs make it difficult to catch up on payments.

This is where debt relief comes in. Organizations like TurboDebt® provide structure and expert assistance to help you reduce and pay off debt. Effective options for debt relief include:

- Debt Settlement

Settling debt can be an effective way to clear $10,000 or more in unsecured debt, especially for large credit card balances. This method can also reduce the total balance you owe when a debt relief company negotiates a settlement on your behalf. - Debt Consolidation

Consolidating debt offers multiple paths toward clearing outstanding balances. Some consumers take out a loan big enough to pay off all current debts in favor of lower interest and a single monthly payment. Others opt for a balance transfer credit card with 0% interest during an introductory period, repaying smaller credit card balances quickly. - Debt Management

Another option for consistently paying off large balances is enrolling in a debt management plan with a credit counseling organization. These groups oversee a consumer’s debt by managing monthly payments for each enrolled account.

Did You Know?

Debt settlement is helpful for clearing large credit card balances through a structured payment plan.

Does TurboDebt Hurt Your Credit?

Enrolling in a debt relief program can impact your credit score based on how you structure payments and how much you owe lenders.

Impact on Credit Scores

Because TurboDebt® offers debt settlement programs for consumers struggling with large balances, our clients may see a negative effect on credit scores as they work to pay off debts and negotiate a reduced balance owed to creditors.

However, with many clients already feeling the pressure of low credit, high interest fees, and growing unpaid balances, the benefits of debt relief often outweigh a temporary decline in credit scores. Consumers who commit to a monthly payment plan typically pay off debts faster than those who make only minimum payments or struggle to pay off large amounts of interest.

Once you pay off debts and begin making regular, on-time payments on credit cards and other accounts, your score can begin to improve. After a period of low credit and debt repayment, consumers can reset their finances and begin making more effective financial choices, leading to stronger credit scores.

Impact on Credit History

Unpaid debts can also impact your credit history in various ways. Missed payments, accounts in collections, and debts that are charged off can last up to seven years on credit reports, whether or not you choose debt relief assistance.

While debt settlement can show up on your credit report in one of these ways as you work to pay off balances, it can also give you a chance to reduce what you owe. Smart buying choices and efficient consumer habits can reshape future credit reports after you clear debt.

Credit Score Basics

What is the importance of a credit score, and how does it impact your financial life? Let’s take a look at how credit scores work and how lenders and credit reporting organizations use them.

What Is a Credit Score?

Credit scores are three-digit numbers representing a consumer’s overall financial habits and risk to lenders. Scores are based on data from three credit reporting bureaus: Experian, TransUnion, and Equifax. Lenders and creditors use these scores to measure and predict a consumer’s ability to make payments and manage credit.

Two scoring models also exist for consumer credit. The widely accepted FICO model and the less common VantageScore use slightly different methods to calculate credit scores. Both models issue scores ranging from 300 to 850, with rankings from “Poor” to “Excellent.”

What Factors Determine Your Credit Score?

Credit agencies use reports from creditors to build consumer profiles and assign scores based on five factors. Here’s an overview:

The three major credit reporting bureaus use each of these factors to build your score, adjusting it frequently to reflect your financial actions. Since payment history and credit utilization make up the biggest part of your score, breaking the cycle of debt and starting with a clean financial slate can set you up for financial success in the future.

Origination, age, and mix are also key factors indicating how often you open new lines of credit, how long you’ve had open credit accounts, and the different types of credit you use.

For example, new adults opening their first credit card are typically assigned lower scores because they have no credit history. Conversely, established consumers with multiple lines of credit who make full and on-time payments usually earn higher credit scores.

How Can You Improve Your Credit Score?

Carrying a low credit score can present obstacles that impact your financial options. Some of the main drawbacks of maintaining a low credit score include paying higher interest rates and facing difficulty when applying for new loans. Once you overcome debt, it’s a great time to start refining your financial habits to improve your score.

Because payment history weighs so heavily in calculating your credit score, simply paying your bills in full and on time can start making a big difference. Managing a few lines of unsecured credit while balancing secured debts like a mortgage or car loan also helps you build up your credit rating.

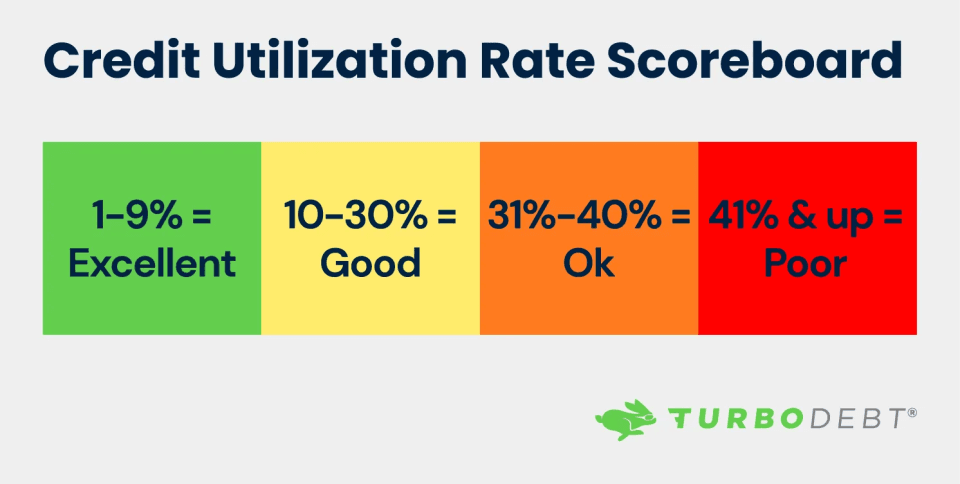

Additionally, it’s important to consider how much of your available credit you use. Known as your credit utilization ratio, the more you owe to creditors, the higher your number. The key is to keep it well below 30% across all your accounts to increase your credit rating.

Are You Ready to Pay Off Debt With TurboDebt®?

TurboDebt® offers customized and affordable plans to help you pay off debt. Specializing in debt settlement services, we negotiate with creditors on behalf of our clients, saving consumers up to 45% on their total enrolled debt (before fees).

The faster you repay debt, the quicker you can start rebuilding credit and setting new financial goals. Learn more with a free consultation from an expert advisor at TurboDebt.

With over 20,000 positive reviews across Trustpilot and Google, we’ve proven ourselves as a trusted partner for debt relief. It only takes a few minutes to find out if you qualify for our debt relief program. Start your journey toward a future free from credit card debt today!